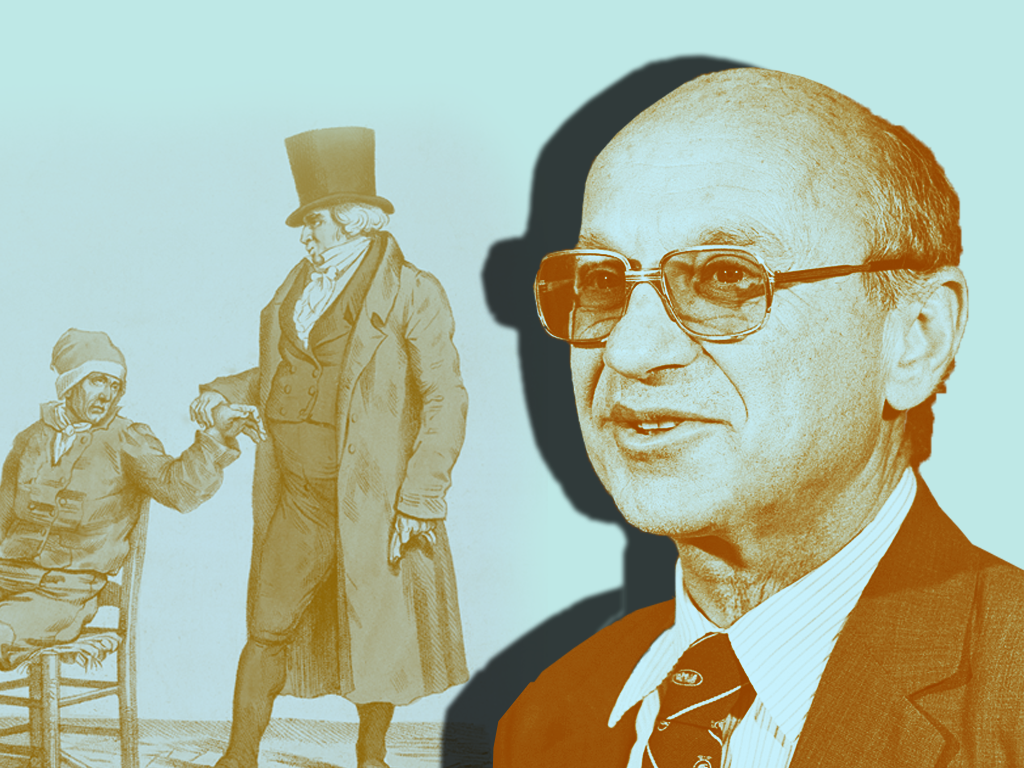

Milton's Myth #7: Markets Are Fair

✑ ROBIN HAHNEL | ± 1 minutes

Even if wages and salaries were determined in competitive labor markets free from discrimination, markets are unfair. (All of Milton's myths here).

But wages in real world capitalism are more inequitable than marginal revenue product wages would be. Minorities and women are not paid the market value of their labor’s contribution. Because of economic discrimination in hiring, promotion, and pay, because of occupational ghettos, and because of unequal educational opportunities inequities in real world capitalism are far worse than they would be in ideal models.

This article is part of a list of refutations of ideas from Milton Friedman and mainstream economists in Robin Hahnel's book 'The ABC's of Political Economy' (2014). See all other myths already published on Socialist Economist here.

‟A surgeon who is on the golf course by 2 p.m. would consume ten times more than a garbage collector.

Even if wages and salaries were determined in competitive labor markets free from discrimination, markets are unfair. (All of Milton's myths here).

Originally published in chapter ten of Hahnel's book The ABC's of Political Economy: A Modern Approach (Pluto Press, 2014).

|

|---|

About the author (click)

Robin Eric Hahnel (1946) is Professor Emeritus of Economics at American University in Washington DC. He has published on marxian economics, liberating theory, economic crises , ecological issues and “participatory economics”. He has frequently contributed to Znet and is the co-director of Economics for Equity and the Environment.

General introduction (click)

This article is part of a series refuting several myths of the neoliberal economist Milton Friedman (1912-2006), extracted from the book ABC's of Political Economy: A Modern Approach (Pluto Press, 2014) by economist Robin Hahnel. The general introduction was included in the first post of this series but can also be found here below↴

When Milton Friedman published Capitalism and Freedom (University of Chicago Press) in 1964 free market capitalism was not yet ascendant. In the post WWII era Keynesian, social democratic capitalism was more dominant, and government regulation and guidance of the economy was generally considered necessary, prudent, and desirable. So Friedman was writing as a dissident when he argued that only free market capitalism can provide economic freedom, promote political liberty, allocate resources efficiently, motivate people successfully, and reward people fairly, and government intervention was usually unnecessary and counterproductive.

By 2002 when the first edition of The ABCs of Political Economy was published neoliberal capitalism stood triumphant over the demise of not only centrally planned Communism, but social democratic, Keynesian capitalism as well. Friedman’s disciples were more confident than ever that free market capitalism was the best economy possible. Deregulation, privatization, and dismantling the social safety net had become the order of the day. Keynesians had been successfully isolated and silenced, and only a scattered tribe of “heterodox economists” any longer challenged Milton Friedman’s claims about the virtues of free market capitalism.

What a difference twelve years can make! While neoliberal capitalism still clings to power almost everywhere in 2014, and especially within the economics profession, there are now many who doubt that free market capitalism is truly the best economic system for the vast majority. Six years after the worst financial crash in four generations the global financial system remains without adequate regulation, and is just as dangerous as it was before the collapse of Lehman Bros. Five years after the largest drop in GDP since the Great Depression unemployment remains high in all the advanced economies with no end in sight. And despite overwhelming evidence that we are on course to unleash disastrous climate change, carbon emissions continue to rise everywhere. While the tongues of all but a few critics were tied in 2002, there are now many voices bemoaning the loss of hard won reforms neoliberals assured us were counterproductive, no longer necessary, or unaffordable. Every day more people are realizing that we are on course for an ecological disaster of Biblical proportions. As our “old economies” continue to fail us, there is rising interest in a potpourri of initiatives that are self-consciously not business-as-usual economics, called the “new” or “future” economy. And finally, there is a notable stirring of renewed interest in alternatives to capitalism altogether. However, it is still instructive to begin a careful evaluation of free market capitalism with a point-by-point response to Milton Friedman’s claims about its purported virtues that have grown to become popular myths about capitalism. After which we can see where criticisms raised by protest movements in Europe and the US during the past five years fit into the long, historic debate over the pros and cons of laissez faire capitalism.

When Milton Friedman published Capitalism and Freedom (University of Chicago Press) in 1964 free market capitalism was not yet ascendant. In the post WWII era Keynesian, social democratic capitalism was more dominant, and government regulation and guidance of the economy was generally considered necessary, prudent, and desirable. So Friedman was writing as a dissident when he argued that only free market capitalism can provide economic freedom, promote political liberty, allocate resources efficiently, motivate people successfully, and reward people fairly, and government intervention was usually unnecessary and counterproductive.

By 2002 when the first edition of The ABCs of Political Economy was published neoliberal capitalism stood triumphant over the demise of not only centrally planned Communism, but social democratic, Keynesian capitalism as well. Friedman’s disciples were more confident than ever that free market capitalism was the best economy possible. Deregulation, privatization, and dismantling the social safety net had become the order of the day. Keynesians had been successfully isolated and silenced, and only a scattered tribe of “heterodox economists” any longer challenged Milton Friedman’s claims about the virtues of free market capitalism.

What a difference twelve years can make! While neoliberal capitalism still clings to power almost everywhere in 2014, and especially within the economics profession, there are now many who doubt that free market capitalism is truly the best economic system for the vast majority. Six years after the worst financial crash in four generations the global financial system remains without adequate regulation, and is just as dangerous as it was before the collapse of Lehman Bros. Five years after the largest drop in GDP since the Great Depression unemployment remains high in all the advanced economies with no end in sight. And despite overwhelming evidence that we are on course to unleash disastrous climate change, carbon emissions continue to rise everywhere. While the tongues of all but a few critics were tied in 2002, there are now many voices bemoaning the loss of hard won reforms neoliberals assured us were counterproductive, no longer necessary, or unaffordable. Every day more people are realizing that we are on course for an ecological disaster of Biblical proportions. As our “old economies” continue to fail us, there is rising interest in a potpourri of initiatives that are self-consciously not business-as-usual economics, called the “new” or “future” economy. And finally, there is a notable stirring of renewed interest in alternatives to capitalism altogether. However, it is still instructive to begin a careful evaluation of free market capitalism with a point-by-point response to Milton Friedman’s claims about its purported virtues that have grown to become popular myths about capitalism. After which we can see where criticisms raised by protest movements in Europe and the US during the past five years fit into the long, historic debate over the pros and cons of laissez faire capitalism.

I

s capitalism unfair only because people get unjustifiable income from ownership of productive property? Or, are labor markets also unfair? Even if wages and salaries were determined in competitive labor markets free from discrimination, a surgeon who is on the golf course by 2 p.m. would consume ten times more than a garbage collector working fifty hours per week, because the surgeon was genetically gifted and benefited from vast quantities of socially costly education. Free labor and capital markets mean that most who are wealthy are so not because they worked harder or sacrificed more than others, but because they inherited wealth, talent, or simply got lucky.‟Distribution according to maxim 2 – to each according to the value of her labor’s contribution – is inequitable.In Chapter 2 we concluded that distribution according to maxim 2 – to each according to the value of her labor’s contribution – is inequitable because income from human capital is unfair for the same reasons income from physical capital is unfair: Differences in the values of people’s contributions for reasons other than differences in effort or sacrifice are beyond people’s abilities to control, and carry no moral weight in any case.

Maxim 2? (click)

In chapter 2 of Hahnel's book The ABC's of Political Economy, previously published on SE, Hahnel discusses and compares three different "conceptions of economic justice" (and explains why he favors the third one):

- Conservative Maxim 1: Payment according to the value of one’s personal contribution and the contribution of the productive property one owns.

- Liberal Maxim 2: Payment according to the value of one’s personal contribution only.

- Radical Maxim 3: Payment according to effort, or the personal sacrifices one makes.

But wages in real world capitalism are more inequitable than marginal revenue product wages would be. Minorities and women are not paid the market value of their labor’s contribution. Because of economic discrimination in hiring, promotion, and pay, because of occupational ghettos, and because of unequal educational opportunities inequities in real world capitalism are far worse than they would be in ideal models.

This article is part of a list of refutations of ideas from Milton Friedman and mainstream economists in Robin Hahnel's book 'The ABC's of Political Economy' (2014). See all other myths already published on Socialist Economist here.

Comments

Post a Comment

Your thoughts...